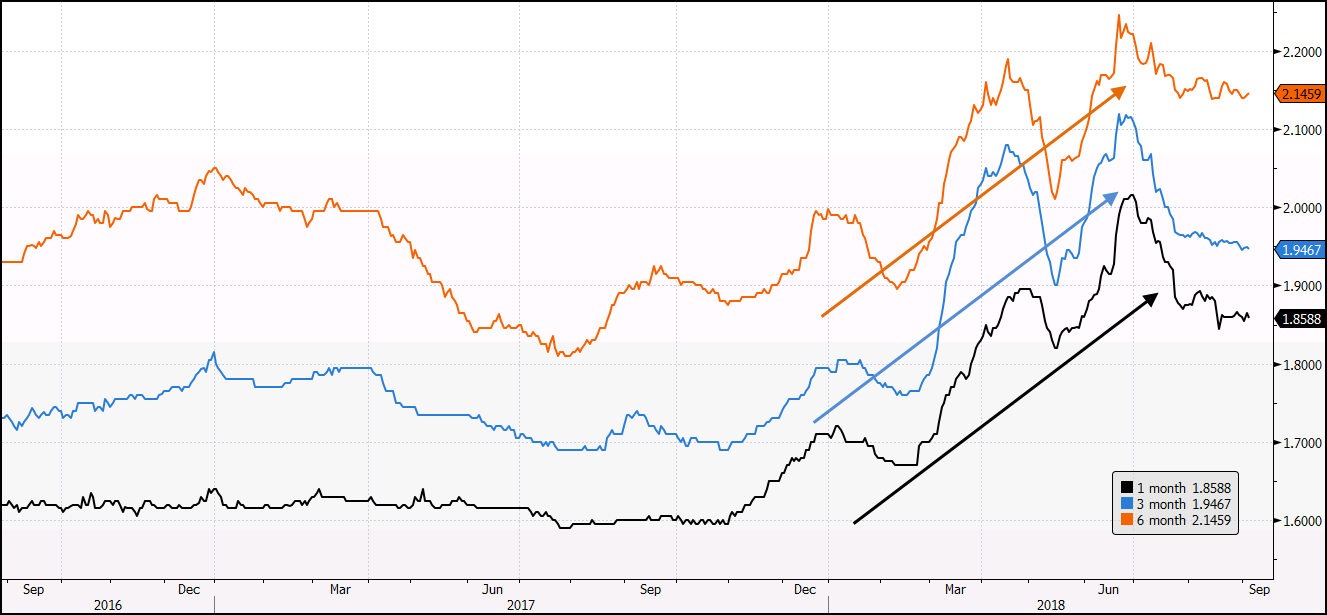

Example of the Bank Bill Swap Rate (BBSW) Let’s say that interest rates for bank bills was 4% for the first six months of the year while rates jumped to 5% and remained at 5% for the second half.. DATE 1 month 2 month 3 month 4 month 5 month 6 month. “ASX”). ASX owns all proprietary rights in the BBSW benchmark rate data and End of Day BAB data (together, “ASX Benchmark Data”).. Bank Bill Swap Rates (Mid) – 10 Day History . Created Date: 5/1/2024 11:00:13 AM.

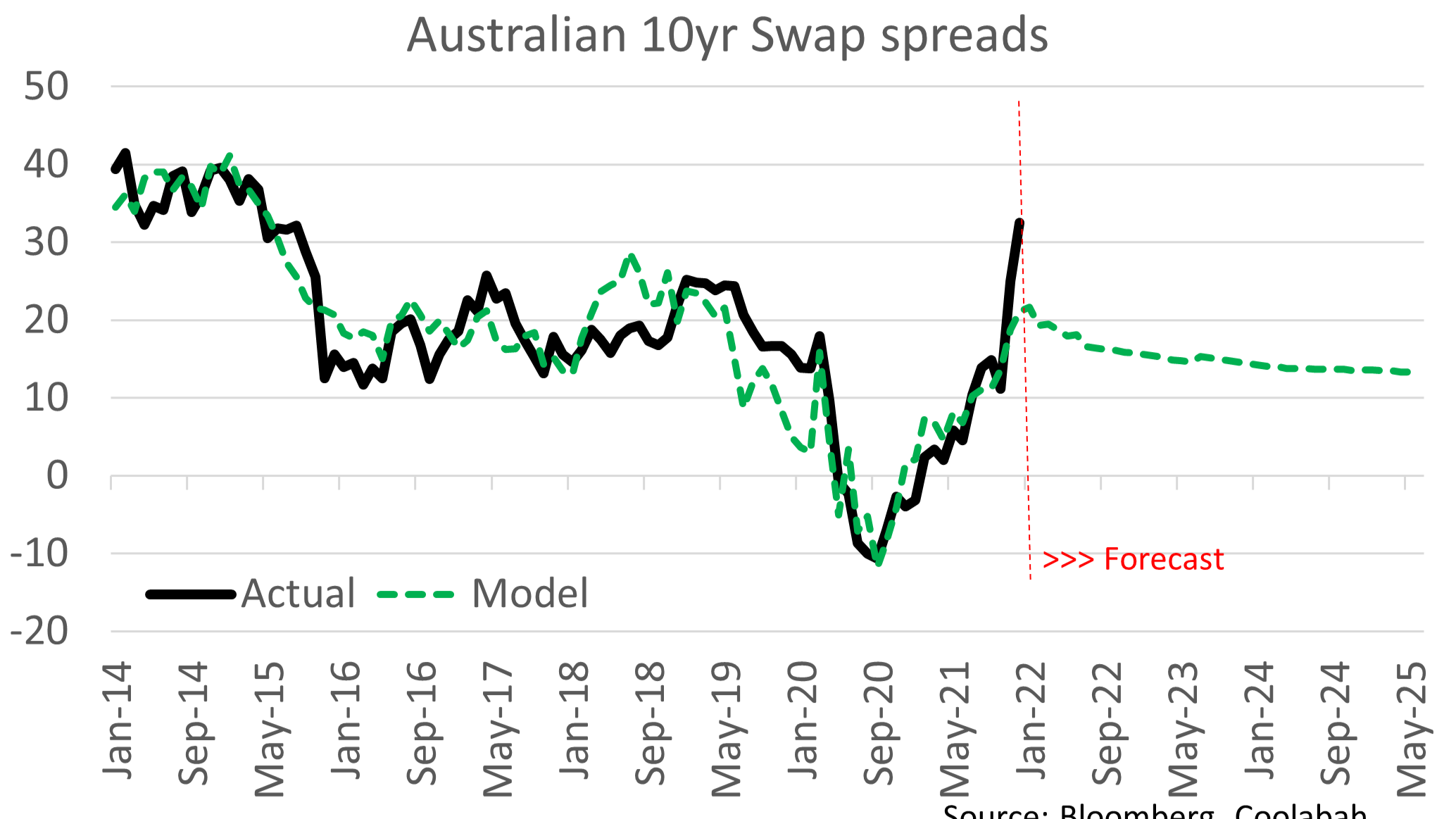

Swap Spread Telegraph

Bbsw Rate

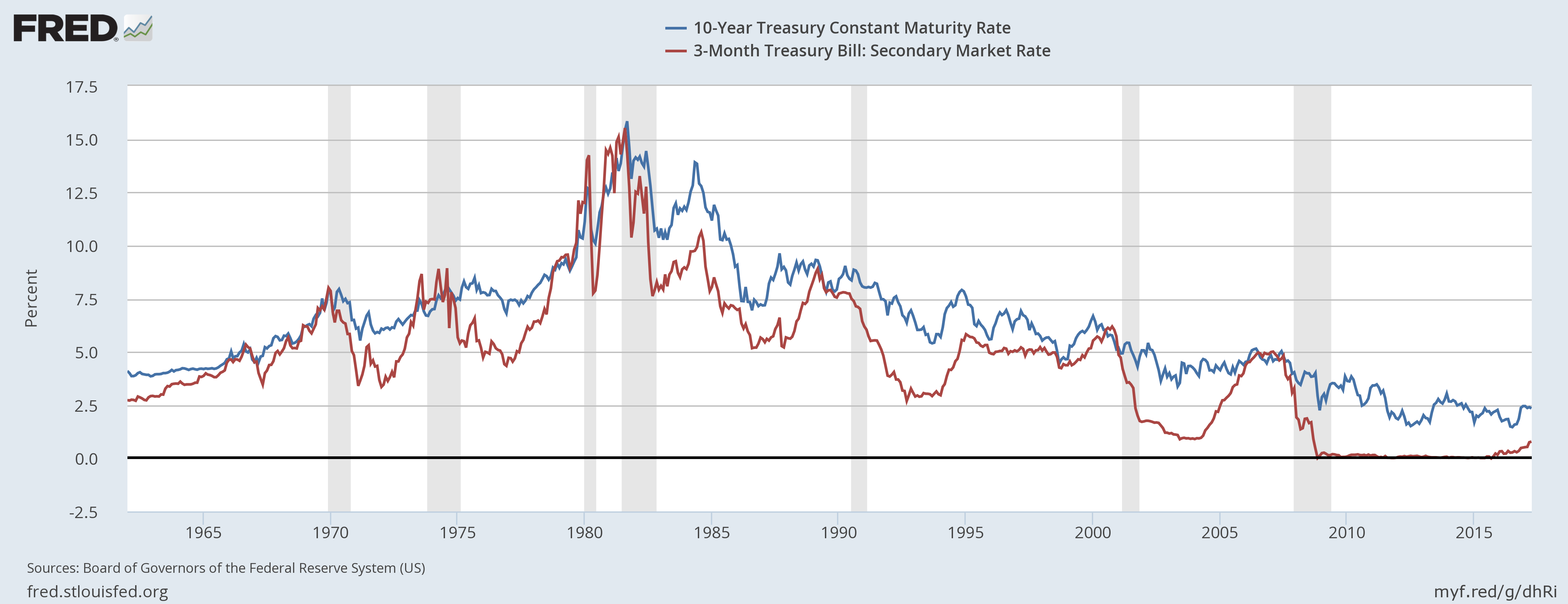

U.S. Bond Market Week In Review A Closer Look At The 10Year, 3Month Spread Seeking Alpha

Bbsw Rate

Bbsw Rate

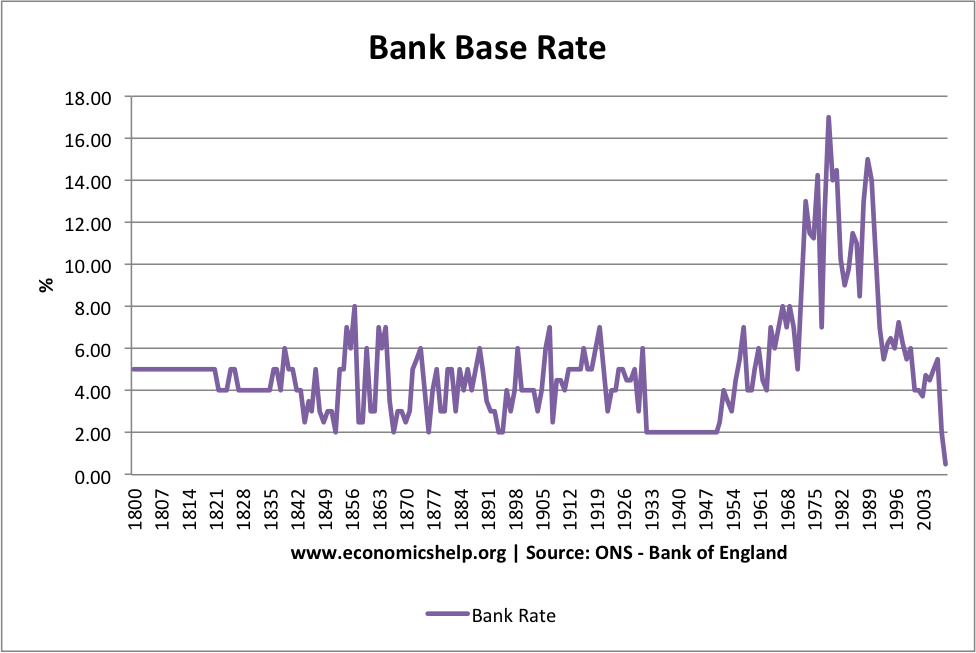

Interest Rates Uk Graph

Bbsw Rate

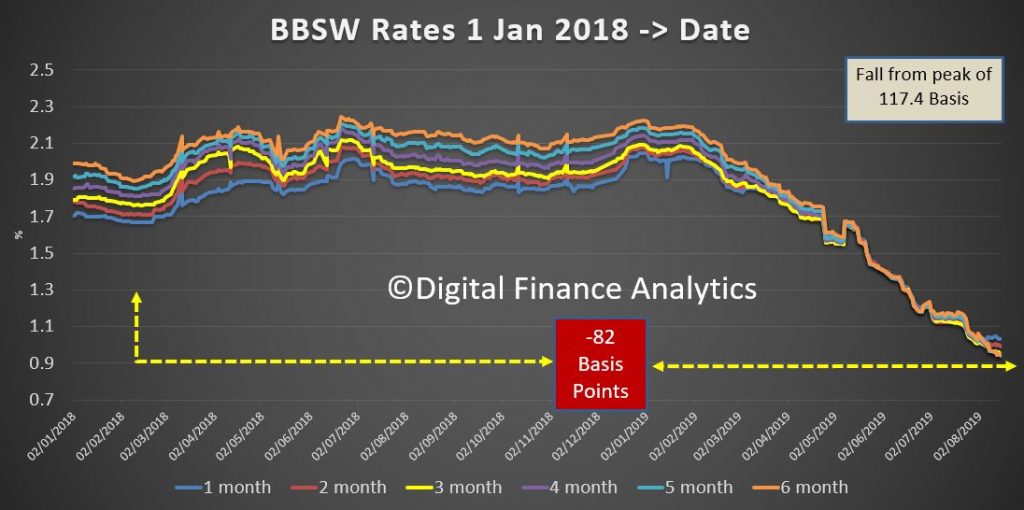

BBSW Digital Finance Analytics (DFA) Blog

BBSW Digital Finance Analytics (DFA) Blog

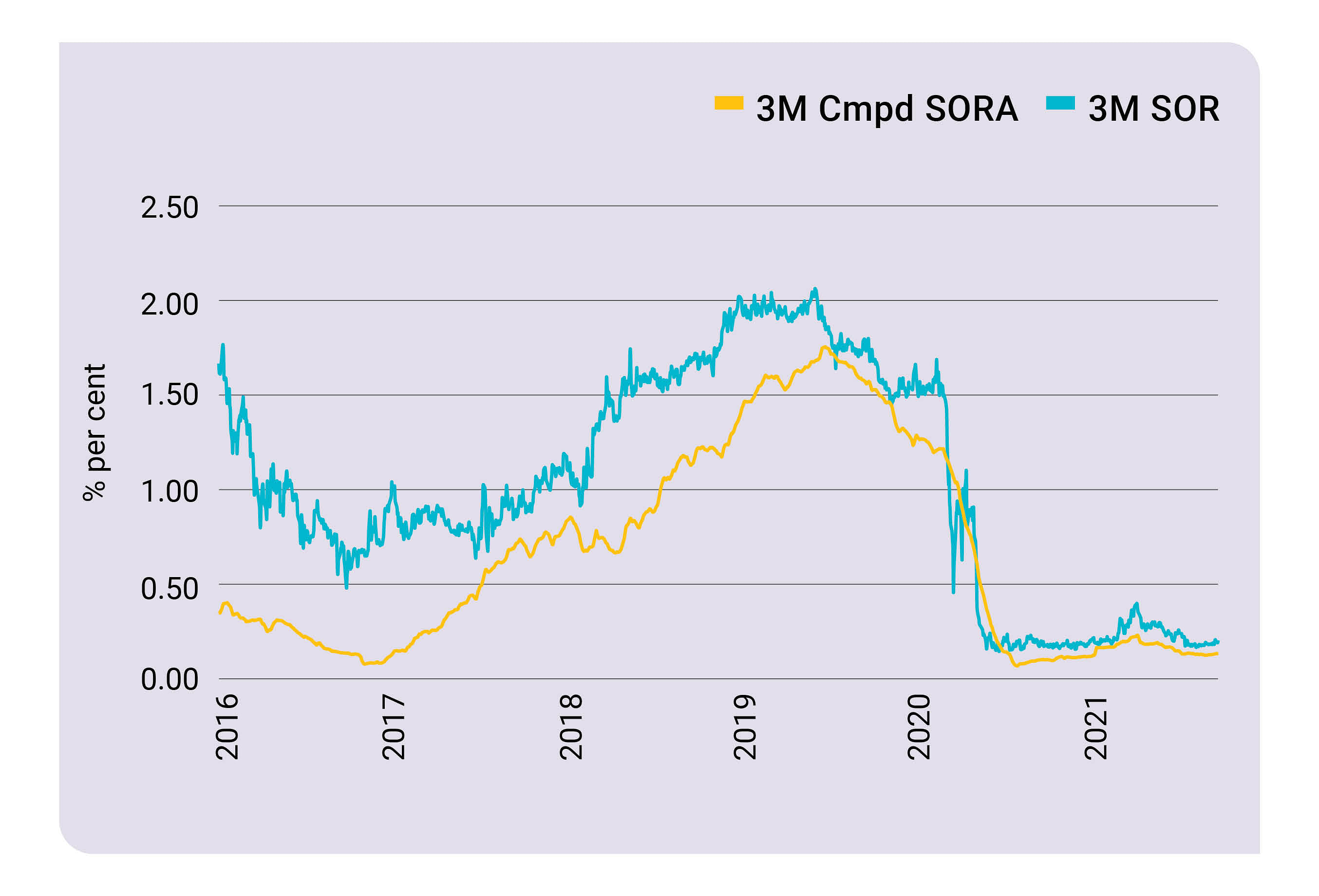

SORA Rates 1Month & 3Month Compounded How Does It Work?

What homeowners need to know about Singapore’s shift to new interest rate benchmark SORA The

Bbsw Rate

Interest Rates 3Month or 90Day Rates and Yields Bank Bills Total for Australia

Bbsw Rate

Bank Bill Swap Rate (BBSW) AwesomeFinTech Blog

Australian Banks’ Global Bond Funding Bulletin August 2006 RBA

This chart shows that the RBA just can’t win even if they do cut rates next month

Developments in Banks’ Funding Costs and Lending Rates Bulletin March 2023 RBA

Hybrid action Eureka Report

Bbsw Rate

OverviewGovernmentBanking InstitutionsReligious InstitutionsInstitutional FundsEducational InstitutionsNot-for-profit InstitutionsCorporateWealth. Contact. Suite 1801, Level 18, 1 Bligh St, Sydney, NSW, 2000Ph (02) 9690 2188. 1300 1 Curve (1300 128 783) [email protected]. Disclaimer. This website is not intended to imply a recommendation or.. The Bank Bill Swap Rate, commonly known as BBSW, is simply the short term swap rate.In Australia, BBSW is the term used for interest rate swaps of six months or less, anything dated longer than six months is simply referred to as a swap rate.. While BBSW has many uses, for fixed income investors its main relevance is as a benchmark upon which we can evaluate floating rate bonds or investments.