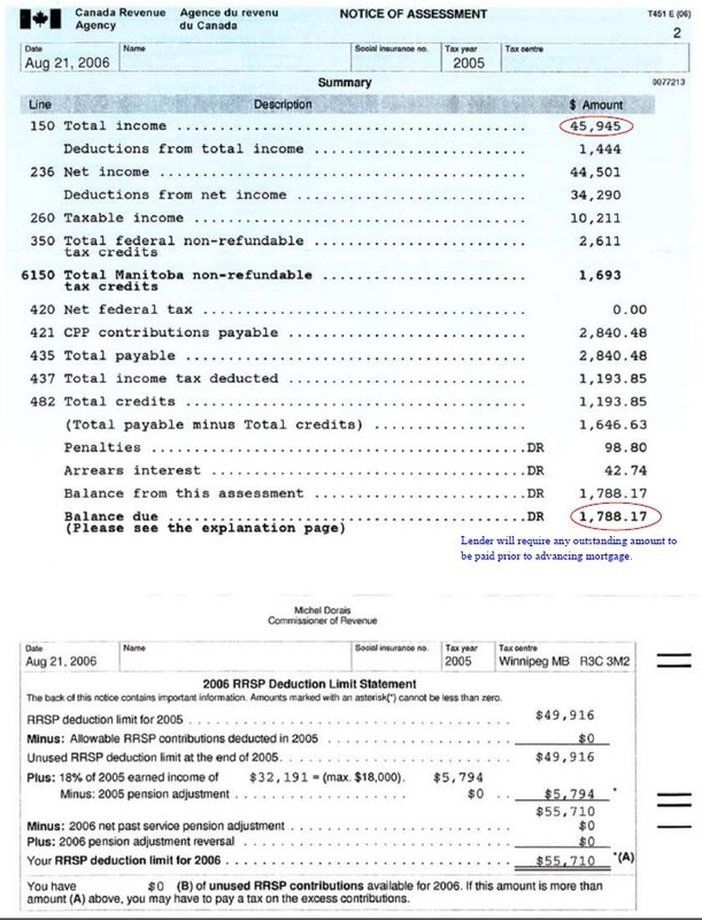

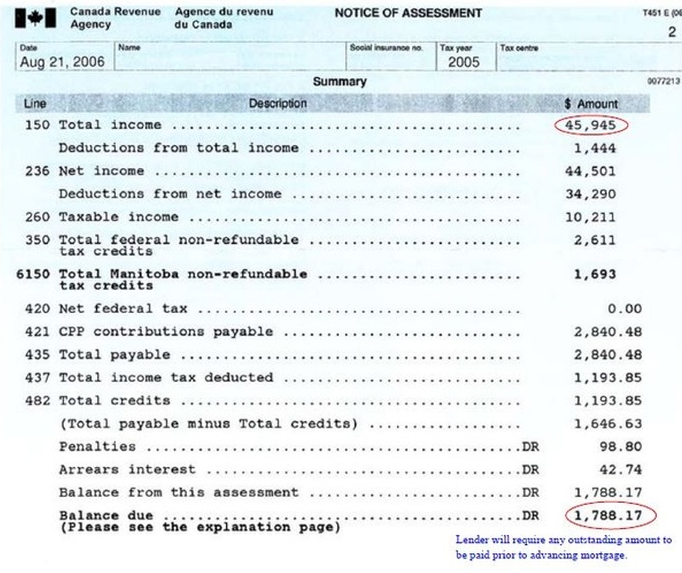

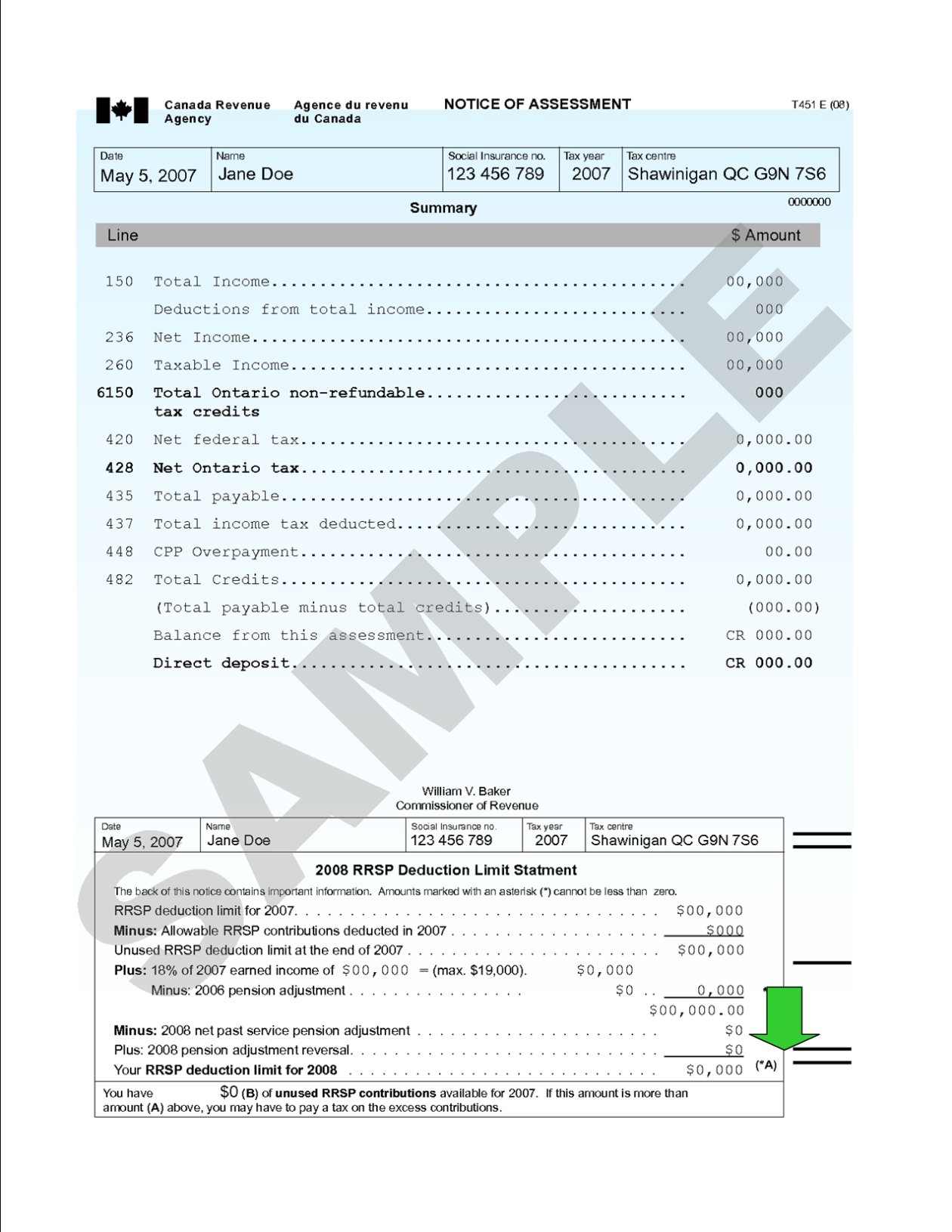

Line 15000 on your tax return lists your total income before deductions, otherwise known as your gross income. It includes not only your wages or salary from your T4 – Statement of Remuneration Paid, but also income from other sources that you may have received. What you make in a year is, after all, often more than just what your employer.. In these cases, recipients of support often argue that the payor is, in fact, earning more income than is reflected on Line 150 of their Income Tax Return and Notice of Assessment. It is also interesting to note that there are cases where a party’s Line 150 income is overstated. In the case of Stober v.

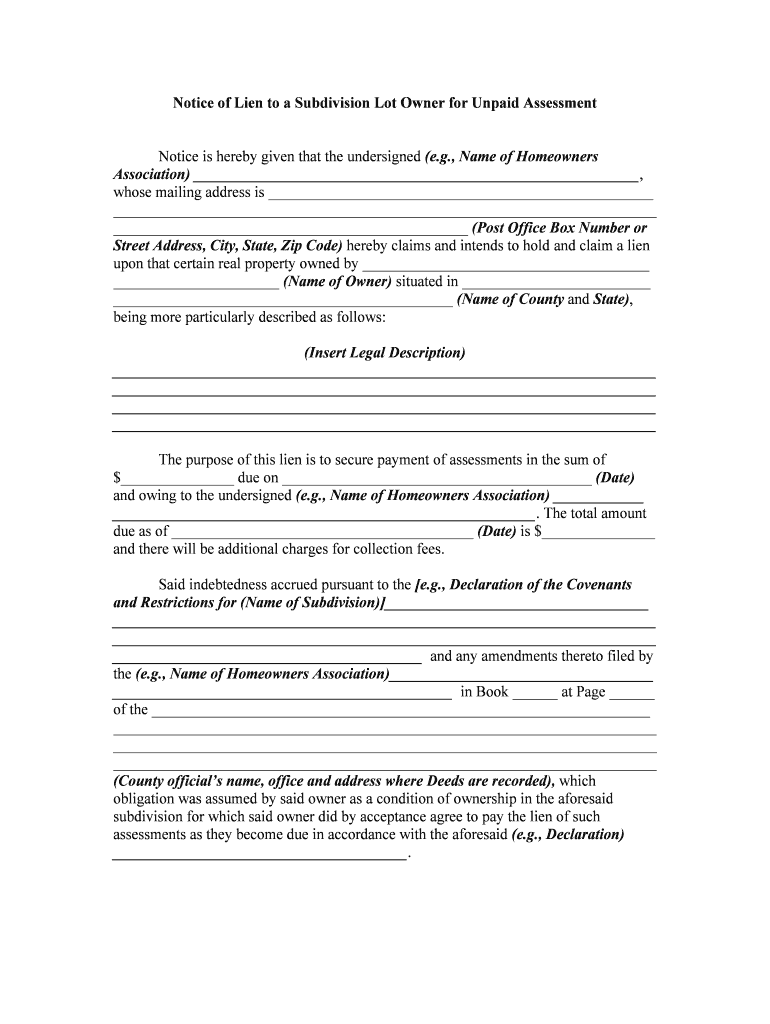

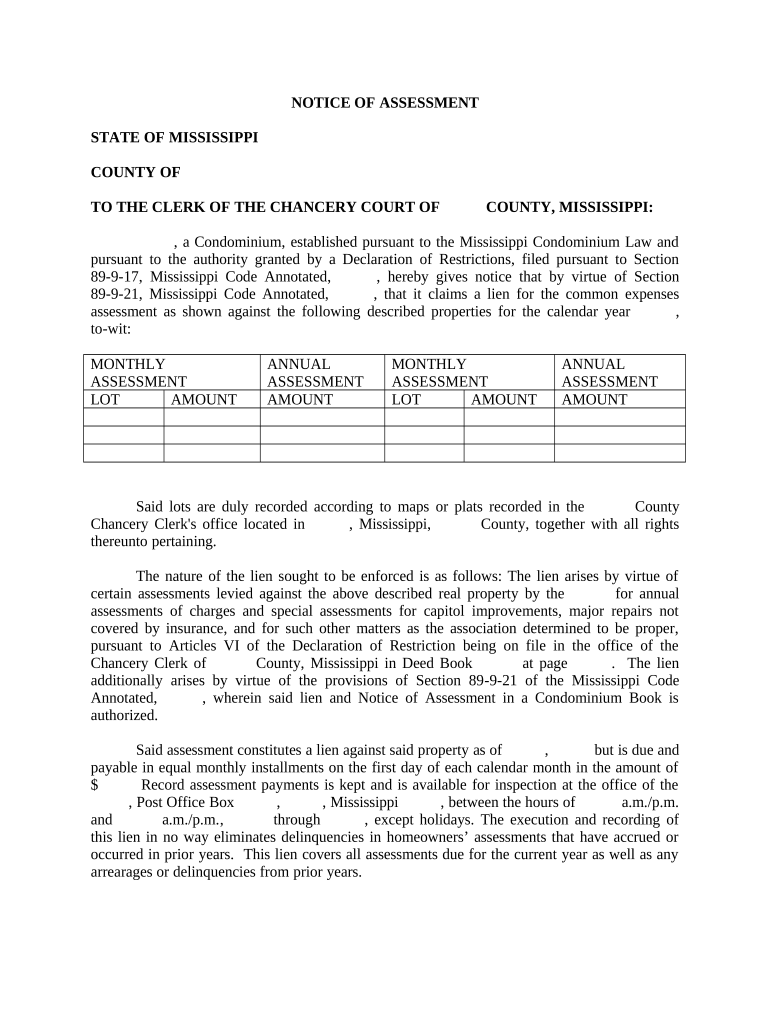

Notice Lien Owner Form Fill Out and Sign Printable PDF Template SignNow

Notice of Assessment

What is a Notice of Assessment (NOA) and T1 General? Filing Taxes

Notice of Assessment Expert Fiscaliste

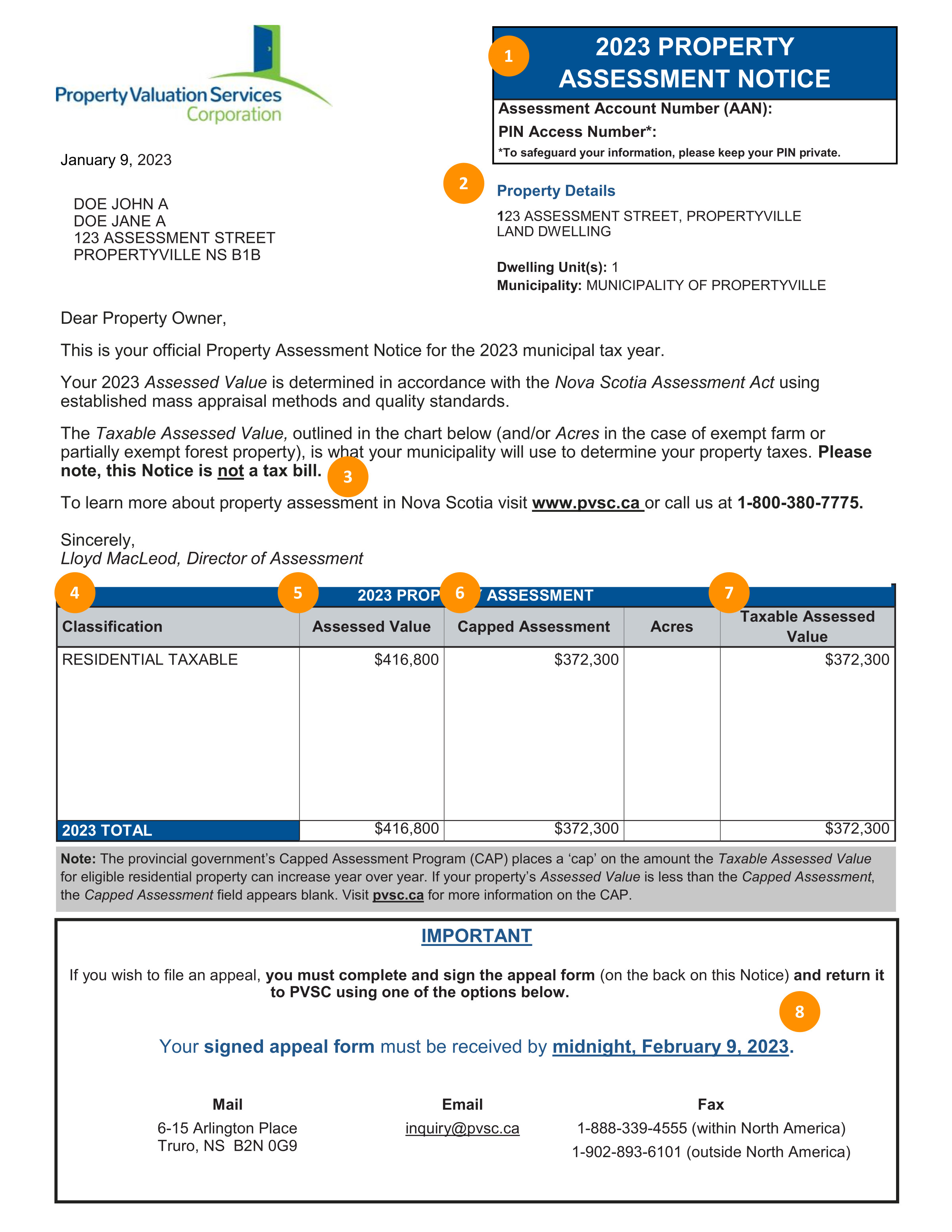

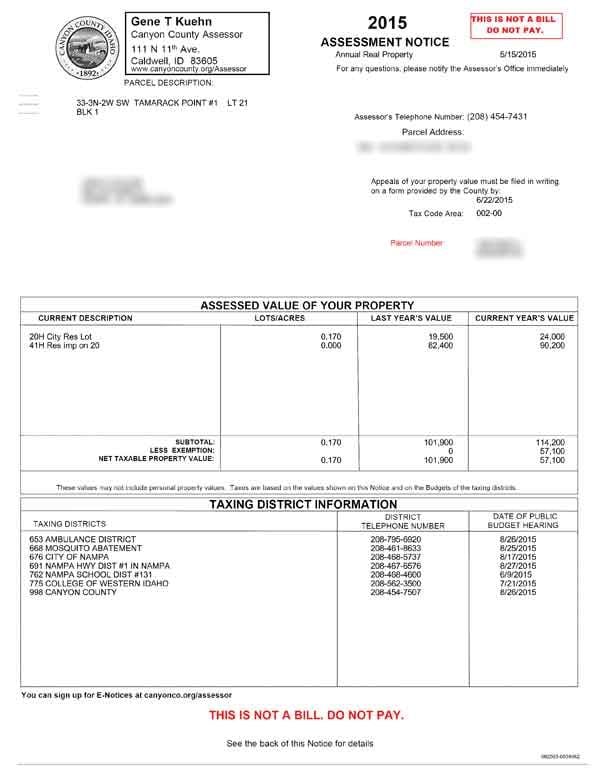

Your Property Assessment Notice Property Valuation Services Corporation

Increase your clients’ using gross ups and add backs Bridgewater Bank Brokers

Document upload guidelines

Example CRA Notice of Assessment Paper Copy The Woollam Mortgage Team

Notice of Assessment Mackenzie Gartside & Associates

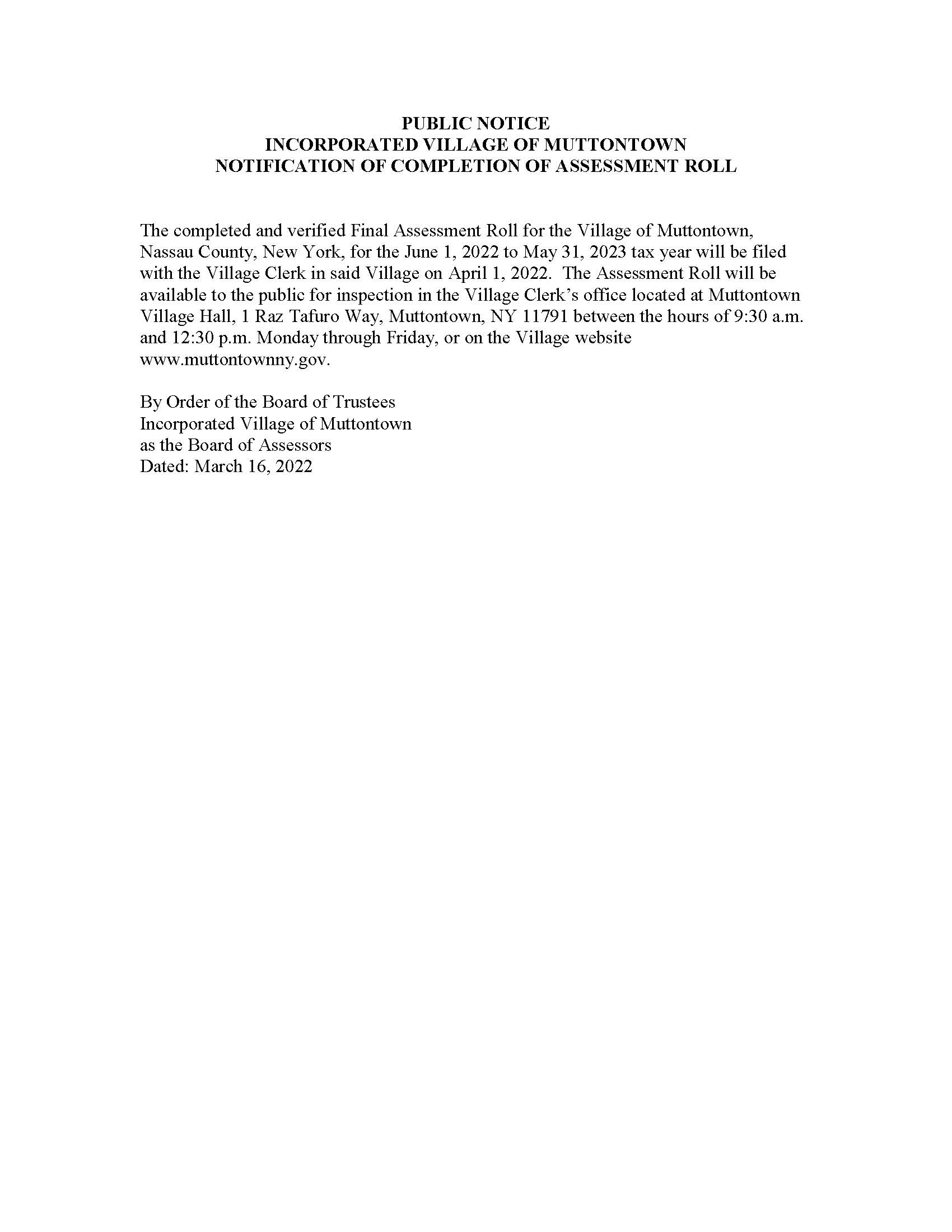

NOTICE OF COMPLETION OF FINAL ASSESSMENT ROLL Minerva New York

Articles Understanding the CRA Notice of Assessment Fund Library

Notice of Assessment Tax Form Federal Notice of Assessment in Canada 2022 TurboTax® Canada

What Is A Notice Of Assessment? Loans Canada

What’s the difference between your Mortgage Documents?

Notice Assessment Sample Form Fill Out and Sign Printable PDF Template SignNow

Public Notice 20222023 Final Assessment Roll Village of Muttontown

After sending us your tax return Learn about your taxes Canada.ca

What to know about your property assessment Members

What’s the difference between your Mortgage Documents?

EAS Frequently Asked Questions QTAC

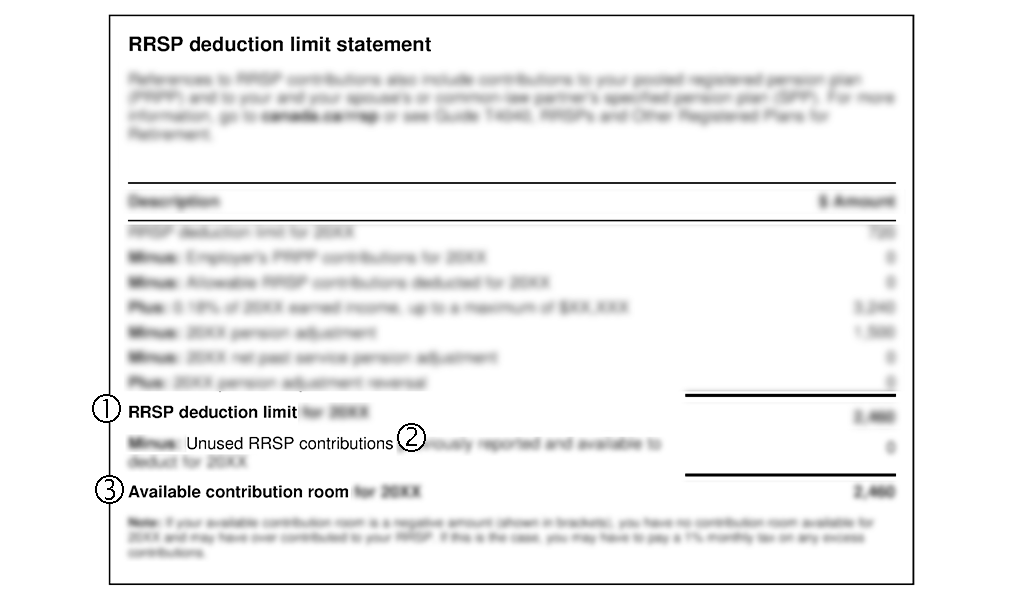

If line 15000 (150 for 2018 and prior years) in your most recent return or notice of assessment includes pension or RRSP income, then you may need to adjust that income. You cannot deduct the amount you put into an RRSP or any other pension plan from the amount of income used to calculate child support.. Using the amount on line 150 on your income tax return (or notice of assessment from the Canada Revenue Agency), and then minus any union dues from that amount; Looking at your pay stubs for a full year and adding up what you were paid each month (before all the taxes were taken off)